Digital Payments Surge, But India’s Poor Still Remain Unbanked — TruthWave India

India’s push toward a “cashless economy” has accelerated over the past decade. Mobile wallets, UPI transfers, online bank services and app-based payments are now household terms in major cities. For many, it’s a sign of progress — of technology, efficiency, and convenience. For millions more, however, it’s a growing wall of exclusion.

According to a 2024 Reserve Bank of India (RBI) survey, nearly 25 percent of Indian households remain unbanked, with no access to formal banking or digital payment infrastructure. In rural areas and urban informal settlements, the digital finance revolution hasn’t reached many, or arrives only partially — often with hidden charges, poor network access, and little clarity on usage.

In pushing the narrative of a digitally empowered nation, the State and the private sector risk leaving the poor further behind.

Financial Inclusion Is a Constitutional Imperative — Not Just Economics

The Constitution of India guarantees dignity, equality, and the right to livelihood. Article 21 guarantees the Right to Life, encompassing economic and social rights. Article 38 tasks the State with promoting economic welfare of citizens. The shift to digital payments should not become a barrier for those already vulnerable.

When essential services — subsidies, wages, pensions — move exclusively to digital platforms, individuals without bank accounts or mobile access are effectively excluded. Denying access to basic financial tools in a cashless push is equivalent to denying citizenship; it undermines the constitutional promise of equality and inclusion.

Who Suffers Most Under India’s Cashless Push

Those most impacted include:

- Daily wage labourers and migrant workers — without stable bank accounts

- Residents of informal settlements lacking bank or mobile infrastructure

- Women in rural areas with limited internet or device access

- Elderly people unfamiliar with digital modes or without documents

- Small shopkeepers with irregular power or connectivity

- Unorganized sector workers paid in cash

For many, the shift to digital payments turns simple transactions into complex obstacles — from receiving wages, to buying essentials, to accessing subsidies.

A Real Story: Exclusion in the Name of Digital Progress

In a roadside eatery in Lucknow, 45-year-old Ramesh — a daily wage labourer — was told by his employer that payment will be transferred via UPI. He doesn’t have a bank account. He doesn’t own a smartphone. He depends on cash.

“That day I went hungry,” he said. “They said cash payments are over. How should I pay rent?”

Ramesh is not alone. Thousands like him face daily exclusion from a system they helped build with their labour.

Why the Digital Finance Revolution Fails the Poor

- Lack of smartphones or internet connectivity

- No formal identity documents for many migrants

- Poor digital literacy — especially among older generations

- Hidden costs: data charges, transaction failures, delayed settlements

- Unstable network connectivity, especially in rural zones

- Dependence on cash for informal sector work

- No physical bank or ATM access in remote areas

The revolution benefits those already privileged. The rest remain stranded.

What India Must Do to Ensure Financial Inclusion for All

- Maintain cash-based options alongside digital payments

- Expand banking and financial infrastructure in rural and peri-urban areas

- Provide low-cost or free basic banking — no minimum balance requirements

- Offer financial literacy campaigns in regional languages

- Subsidize data and mobile access for low-income families

- Ensure wages, pensions, subsidies are accessible via cash or digital, as recipients choose

- Regulate digital transaction costs strictly

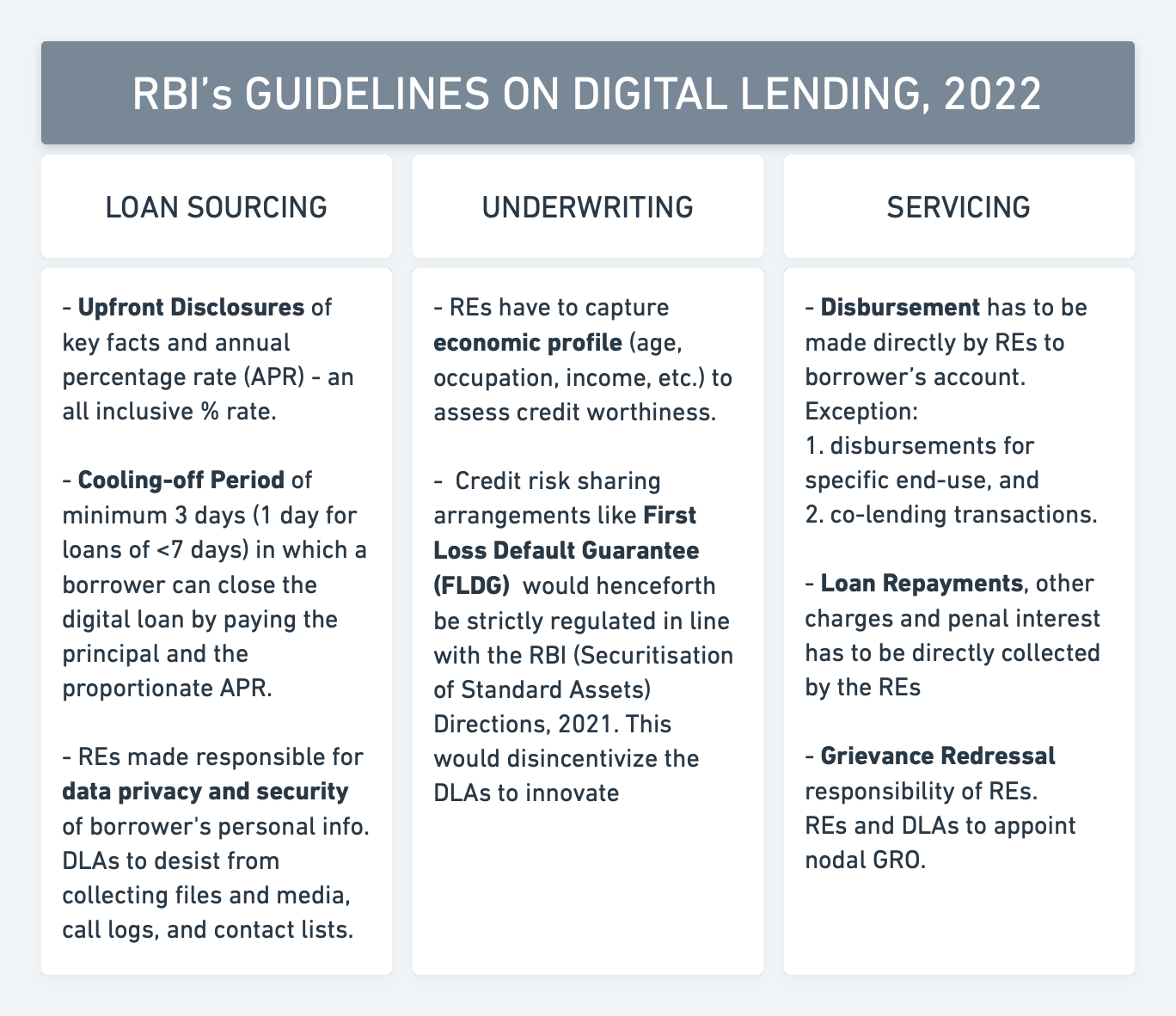

- Strengthen grievance redress systems for transaction failures

Financial inclusion should not be a luxury—it must be a right and constitutional guarantee.

SEO DESCRIPTION

TruthWave India investigates how India’s shift to digital payments and cashless economy excludes millions of poor citizens lacking bank access, smartphones, or literacy — examining constitutional rights, social inequality and urgent reforms needed for inclusive financial justice.

SEO KEYWORDS

India digital payments exclusion, cashless India poor, financial inclusion India, unbanked households India, daily wage workers cashless, Article 21 economic rights, informal sector India, TruthWave India.